Eligible pensioners can claim more than £14,000 worth of freebies and discounts in February.

State pensioners across the UK can boost their income by up to £14,139 from Febraury with 12 freebies and discounts from the government.

The money is available via several Department for Work and Pensions (DWP) winter schemes and benefits which can help give eligible households an extra dose of cash, potentially up to thousands of pounds worth of support. Several DWP schemes, including the Winter Fuel Payment, Warm Home Discount Scheme and Cold Weather Payments are due to end on March 31, 2026, so there’s not long left for those who qualify to get the support. There’s also a 4.8% uprating to the State Pension to come from April, which will give some pensioners up to £575 extra per year in 2026, but some may also be entitled to claim additional financial support before the new rates kick in.

So if you’re looking for ways to boost your income in 2026 ahead of the State Pension uprating in April, it’s worth checking your entitlement for Pension Credit as this DWP benefit can unlock a swathe of freebies and discounts that are worth around £14.139.20 on average.

Pension Credit acts as a gateway to a wealth of other financial support (Image: Getty)

Pension Credit provides pensioners on a low income with extra money to help with living costs and according to the DWP it is worth over £3,900 per year. But it also opens the doors to a wealth of other financial support, including the Winter Fuel Payment, Council Tax discount and help with heating bills, so it’s well worth checking if you qualify.

Sarah Pennells, consumer finance specialist at Royal London, said: “Pension Credit is a valuable benefit because it is a ‘gateway’ benefit. That means, if you’re able to claim it, you may also be able to get help with housing costs (through Council Tax discount and Housing Benefit or Support for Mortgage Interest).

“You’re also eligible for a free TV licence if you’re aged 75 or over and you may be able to get help with NHS dental treatment, prescriptions and transport costs.

“If you’re entitled to these benefits, the state help you get could be very valuable and that could make a real difference to your finances. However, hundreds of thousands of people are missing out on Pension Credit. Our research showed that two in five people over State Pension age hadn’t checked to see if they were entitled to Pension Credit.”

So if you’re in need of a financial boost this month, it’s worth checking your eligibility for Pension Credit – plus one other DWP benefit – as it could unlock financial support worth up to £14,139.20. Listed are 12 freebies and discounts pensioners could claim in February.

Pension Credit – £3,900

Pension Credit tops up your weekly income to £227.10 if you’re single or your joint weekly income to £346.60 if you have a partner. You must live in England, Scotland or Wales and have reached State Pension age to qualify for Pension Credit, and it is worth over £3,900 per year on average according to the DWP.

If you are entitled to Pension Credit, the benefit also unlocks a wealth of other freebies and discounts which means you could also get the following:

Housing Benefit – £1,000

If you rent your home and you get the Guarantee element of Pension Credit then you’re eligible for the maximum Housing Benefit entitlement from your local council. This isn’t a fixed amount, but Martin Lewis’ MSE says you could get around £1,000 per year, and potentially have your rent paid in full.

Free TV Licence – £174.50

Anyone aged 75 and over and claiming Pension Credit can get £174.50 off their TV Licence bill, cutting it down to £0.

Heating bills discount – £150

Pension Credit entitles you to help with heating costs through the Warm Home Discount scheme, which knocks £150 off your electricity bill.

Households in England or Wales will qualify if they are the named billpayer on their energy bill, and receive any of the following means-tested benefits:

- Housing Benefit

- Income-related Employment and Support Allowance (ESA)

- Income-based Jobseeker’s Allowance (JSA)

- Income Support

- Pension Credit

- Universal Credit

If you live in England or Wales, your electricity supplier will apply the discount to your bill automatically. If you live in Scotland, energy suppliers set the criteria for the scheme so households should contact their supplier to check their eligibility.

If you qualify, your electricity supplier will apply the discount to your bill by March 31, 2026, so you’ll receive the energy bill support before April.

Council Tax discount – £1,600

Pension Credit claimants can get a Council Tax discount. The exact amount you’ll get depends on your local council, but it can be anything from around £300 for a 25% reduction on a typical Band D bill up to around £1,600 for a 100% discount.

Winter Fuel Payment – up to £300

Pension Credit claimants are also eligible for the Winter Fuel Payment which is worth between £100 and £300. The amount you get is based on when you were born and your circumstances during the qualifying week between September 15 and 21, 2025.

Most pensioners who are eligible should have received their payment automtically in November or December, but it’s possible some may receive their payment slightly later.

The DWP says anyone who hasn’t received a letter about the payment, or the money hasn’t been paid into their account by January 28, 2026, should contact the Winter Fuel Payment Centre. The deadline to make a claim for winter 2025 to 2026 is March 31, 2026.

Free NHS prescriptions – £9.90

Claiming Pension Credit will also entitle you to free NHS prescriptions, which currently cost £9.90 per item in England.

Free eye care – up to £215

If you get any of the Guarantee element of Pension Credit then you are entitled to help with NHS eye care, including a voucher for glasses or contact lenses. According to Martin Lewis’ MSE, this could be worth up to £215, depending on your prescription.

Free NHS dental treatment – up to £1,000

Pensioners who qualify for the Guarantee element of Pension Credit are also entitled to free NHS dental treatment, including anything from a simple check up to full dentures. According to Martin Lewis’ MSE, this could amount to up to £1,000 worth of free treatment per year.

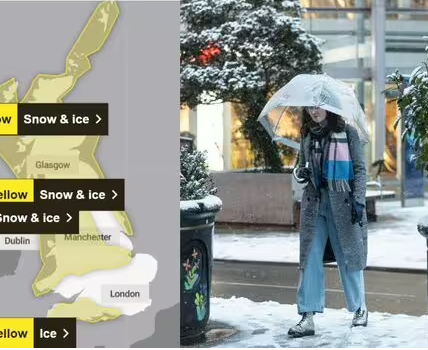

Cold Weather Payment – £25

If the temperature where you live drops to 0C or below for seven consecutive days, you’ll be eligible for a Cold Weather Payment. This is automatic if you’re on an eligible benefit such as Pension Credit, Income Support or Universal Credit.

The DWP will issue the payment to eligible households between now and March 31, 2026, so it’s possible more payments will be triggered before then if another bout of freezing weather strikes.

Royal Mail redirection discount – £24

Pension Credit claimants are entitled to a discount on the Royal Mail redirection service if you’re moving house. The service normally costs £84, but you’ll only have to pay £60 – giving you a saving of £24.

You can start an application for Pension Credit up to four months before you reach State Pension age – which is 66 for both men and women – and any time after, but your application can only be backdated by three months. You can apply online via GOV.UK or by calling the Pension Credit claim line on 0800 99 1234.

Attendance Allowance – up to £5,740.80

Attendance Allowance helps with extra costs if you have a disability severe enough that you need someone to help look after you and is worth £73.90 per week for the lower rate or £110.40 per week for the higher rate.

If you have a severe disability which means you require regular assistance day and night, you could claim the higher amount. There are a total of 56 categories of conditions which could make you eligible. If you get the higher rate this could be worth up to £5,740.80 per year.