EXCLUSIVE: Rachel Reeves is set to deliver her statement in the Commons at 12.30pm on Wednesday.

Rachel Reeves is under pressure to deliver (Image: Getty)

Rachel Reeves risks “squeezing the British economy to death” with her tax-and-spend agenda, a financial expert has warned ahead of tomorrow’s high-stakes spending review. The Chancellor’s plans, according to tax consultant Bob Lyddon, founder of Lyddon Consulting Services, risk creating a “double debt mountain” — a visible government debt and a hidden, growing liability inside state-backed schemes that will ultimately burden British businesses and households.

Mr Lyddon told the Express: “Rachel Reeves has squeezed herself. The only question is whether she is going to squeeze the British economy to death before financial markets stop her.” Since taking office, Ms Reeves, who is set to deliver her statement in the Commons at 12.30pm on Wednesday, has faced mounting pressure over the gap between her rhetoric and results. Her October Budget promised to raise significant funds from VAT on private school fees and a crackdown on non-doms — but both policies have run into legal and technical obstacles and are yet to deliver the expected revenue.

A demonstration against welfare cuts staged in London by the People’s Assembly (Image: Getty)

The economic impact is already being felt, with rising unemployment and falling job vacancies fuelling fears that Ms Reeves’ approach is beginning to choke off growth.

Mr Lyddon claimed: “The only ‘growth’ in the economy is in activities like hospital services, social work, and sewage disposal, enabled by increased public borrowing.

“That ‘growth’ fiddles with the numbers but does not produce taxes for the Government or wealth for the nation.

“The only things that stick with Ms Reeves are spending increases, tax increases, and higher public sector pay and job numbers.

“Any spending moderations she will announce under her Spending Review will be illusory, and will in due course be reversed.”

Spending on day-to-day costs will continue to go up, borrowing to meet those costs will go up, and government ‘investment’ spending will also rise — along with borrowing to fund it, the expert believes.

Mr Lyddon said: “Even the government’s own borrowing for investment will not be the total amount borrowed for the government’s schemes, be they for Net Zero, roads, bridges, or whatever.”

The balance, he went on, “will be borrowed from private pension funds, BlackRock” or others.

He added: “The upshot will be a double debt mountain: the Everest you can see and the K2 hidden inside these schemes, and both being repayable by hapless British businesses and individuals.”

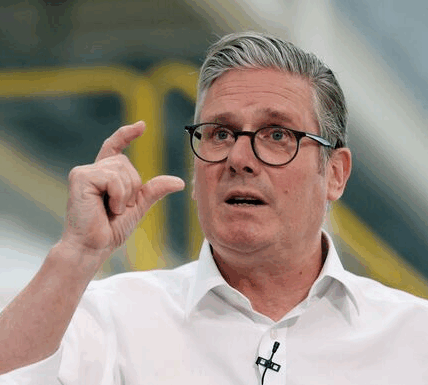

Rachel Reeves and Prime Minister Sir Keir Starmer (Image: Getty)

The Chancellor has already faced a high-profile retreat this week after backtracking on plans to means-test winter fuel payments, following an outcry from pensioners and MPs.

She is also under growing pressure to reverse proposed reforms to agricultural inheritance tax reliefs, which have angered farmers and triggered a backlash from rural Conservative MPs.

Ms Reeves has positioned herself as a safe pair of hands capable of reassuring markets and restoring confidence after years of turbulence. However, recent data suggests her policies may be having the opposite effect, weakening confidence without delivering meaningful growth.

City analysts warn that if borrowing continues to rise while tax receipts disappoint, the UK could face a repeat of past fiscal crises — particularly if global interest rates remain high. Some have even suggested that only a major financial crash will force a rethink, although few in Government are willing to acknowledge that possibility.

Mr Lyddon said: “This will only come to an end — and Britain will only escape the worst long-term damage from the heedless incompetents currently in power — if we experience a major financial crash before the end of the summer.”

Tomorrow’s Spending Review is expected to set out multi-year departmental budgets alongside revised projections for borrowing and growth. Ms Reeves has insisted the plans will be fully costed and transparent and pledged not to return to the days of “fantasy economics.”

But Mr Lyddon said the numbers do not add up. He added: “This isn’t growth, it’s an illusion built on borrowing. Eventually, someone has to pay — and it won’t be the Government.”