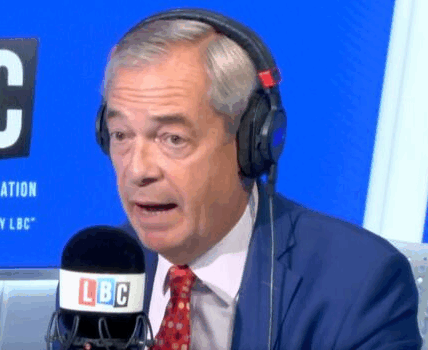

The Chancellor of the Exchequer is due to unveil her latest policies on November 26, which are expected to include changes to pensions and inheritance tax.

Rachel Reeves will unveil her Budget on November 26 (Image: Getty)

Pension savers have been warned that they may be “underprepared” for retirement and must take action, as it is feared that Rachel Reeves will change the rules in her upcoming Budget. Experts at wealth management firm Saltus warn that some Brits do not currently have enough saved in their pots in order to fund their retirement, as data suggests fewer than one in 10 high net worth individuals (HNWIs) contributed the full £60,000 allowance last year, and just 14% plan to do so this year. This is despite concern that the Chancellor of the Exchequer may be set to target pensions relief and change the way inheritance tax (IHT) works to raise revenue that would help plug a gap in the public finances.

Specialists say most HNWIs are not taking advantage of the available tax relief, whilst noting that the £60,000 annual allowance applies only to relevant earnings and may be tapered for higher earners. This means that not everyone can contribute the full amount. Under contribution should be seen in the context that the average pension pot among HNWIs remains “well below the level needed” for what respondents believe to be a “comfortable retirement income”, Saltus highlights.

Savers have been issued advice by experts. (Image: Getty)

Almost half of 2,000 UK respondents who possess £250,000 or more in investible assets – not including primary residence respondents – believe the Government will seek new ways to tax wealth, including through changes to pensions and IHT, the firm adds.

Most respondents said they are actively exploring ways to protect their pension from IHT, with 29% considering trusts or other financial vehicles to “reduce exposure” and 30% reviewing or adjusting their long-term retirement plans to achieve the same goal.

More than a quarter (28%) say that they are “concerned that IHT changes could affect how they pass on their pension benefits”.

Saltus also reports that the introduction of VAT on private school fees has also “had a tangible impact”, with the vast majority of parents with children in private education (71%) saying it has affected their finances.

“With rising living costs, ongoing family support and tax uncertainty, many affluent households are being pulled in multiple directions, leaving less room to prioritise pension planning,” the company said.

Expert advice

Henrietta Grimston, Chartered Financial Planner at Saltus, said: “It’s clear from our latest data that even those with significant wealth are struggling to plan effectively for retirement. Many high earners are underestimating what they’ll need for the lifestyle they want and are not making the most of the generous allowances available.

“At the same time, financial pressures – from supporting children and elderly relatives to rising costs – are clearly impacting how much people can save. This makes it even more important to plan proactively.”

She added: “Pensions remain one of the most tax-efficient ways to build long-term security, yet too many people view them in isolation or as a passive tool to accumulate a retirement income. Retirement planning should look at the full picture – pensions, ISAs, property, business interests and intergenerational transfers – to make sure each part is working together.

“With speculation around tax changes and the possibility that pensions relief could be targeted in the next Budget, now is a good time to review your strategy, use available allowances, and ensure your long-term goals still stack up. Financial planning isn’t about reacting to every policy change, but building flexibility and resilience so that, whatever the Government does next, your future remains on track.”