Lee Anderson Slams ‘Tax-Dodging’ Rachel Reeves in Fiery Exchange!

Reform MP, Lee Andreson has hit out at Chancellor Rachel Reeves as she claimed expenses for tax returns help.

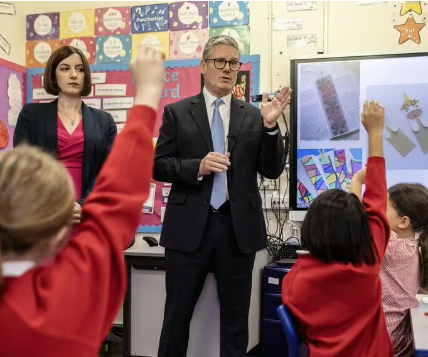

Rachel Reeves has been critised for claiming expenses for accountancy fees (Image: Getty)

As Labour’s first budget is due to be set later this month, the Chancellor has been called out for claiming £1,225 on expenses for an accountant to help her file her tax returns.

In a post on X, Lee Anderson posted a screenshot of a news article confirming the news, along with a message that read: “Robbing Rachel… At it again.”

The post received 4,200 likes, 450 reposts and 459 responses, some agreeing with the Reform MP and others criticising him.

One person said: “The chancellor of the exchequer can’t do her own tax return. Very worrying.”

A second added: “Surely that’s a personal expense and not as part of her job so should be returned?”

A third said that it was “absolutely scandalous”.

The claim included yearly expenses of £137.50 paid to the taxpayer between 2014 – 2022.

Under the rules set by the Independent Parliamentary Standards Authority (IPSA), MPs are allowed to claim accountancy fees if they relate to parliamentary duties – and dozens of parliamentarians from several parties have done so.

However, the news is being met with backlash, especially as the Chancellor is expected to increase taxes in the autumn budget and millions of people fill out tax returns without help.

Critics also argue that MPs can access resources that citizens cannot, such as a fast-tracked HMRC helpline.

In the past year, 47 MPs have made similar claims, with tax experts divided on whether the claims are appropriate, expressing that an MP’s tax return should not be more difficult than any other officeholder’s.