Economic forecasts have been revised following the Government’s significant spending and borrowing plans.

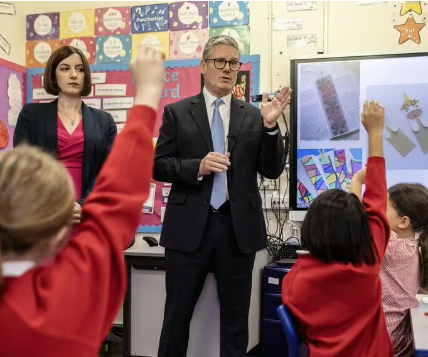

The news comes after Rachel Reeves announced significant spending and borrowing plans (Image: Getty)

UK interest rates will fall less than expected over the next two years following significant spending and borrowing plans outlined in Chancellor Rachel Reeves’s autumn Budget, an influential report has suggested.

In its annual economic survey, the Organisation for Economic Co-operation and Development (OECD), stated that UK inflation is also set to exceed previous predictions next year, and it has upgraded growth forecasts for the economy due to a budget boost.

The OECD maintained that the global economy would “remain resilient” in the coming years, despite acknowledging that “risks and uncertainties are high”.

The organisation predicted that the global economy will grow by 3.2% this year and 3.3% next year, marking a slight improvement from its September interim report’s predictions of 3.1% and 3.2% respectively.

Meanwhile, the UK’s gross domestic product (GDP) is expected to increase by 0.9% this year, a downgrade from its previous forecast of 1.1%. This follows recent data from the Office for National Statistics (ONS) showing that the economy only grew by 0.1% in the third quarter of the year.

Economic forecasts have been revised following the Government’s spending and borrowing plans (Image: Getty)

However, the report added that: “Momentum is positive nevertheless, with retail sales on an upward trend since early 2024.”

It suggested that GDP growth will strengthen to 1.7% next year, driven by the “the large increase in public expenditure set out in the autumn budget”, before slowing to 1.3% in 2026.

Previously, the OECD had predicted a GDP growth of 1.2% for next year.

Economist Julian Jessop, a fellow at the IEA, said: “The OECD is not alone in expecting interest rates to be slower to fall as a result of the additional borrowing in the Budget.

“Indeed the government’s own fiscal watchdog, the OBR, raised its projections for interest rates and the markets have already factored this in.

“If anything, the risk now might be that rates fall more quickly than expected – but only because the tax increases in the Budget are hammering confidence and growth.”

Chancellor Rachel Reeves unveiled plans for an ambitious £70billion per year increase in public spending last October, seeking to finance it through higher taxes and more borrowing.

On Wednesday, the OECD shared forecasts of a decrease in interest rates from the current 4.75% down to 3.5% by early 2026.

However, the autumn Budget’s spur to higher consumption means that this drop may not be as steep as was once anticipated.

The report reads: “Fiscal policy will be tightening over 2024-26, though by less than expected, with significant fiscal loosening in the tax, spending, and borrowing package announced at the autumn Budget.”

This tempered fiscal tightening connects to inflation that has outstripped predictions the OECD now eyes a headline inflation rate of 2.7% for next year, a bump-up from its previous 2.4% estimate.

Inflation is then projected to cool down to 2.3% by 2026, yet it’s still poised to hover over the Bank of England’s target rate of 2%.

Most Popular Comments