As April 1 approaches, millions of struggling households are bracing for the arrival of a financial hurricane. Council Tax hikes loom large, leaving many to wonder what they really get in return for parting with their hard-earned money.

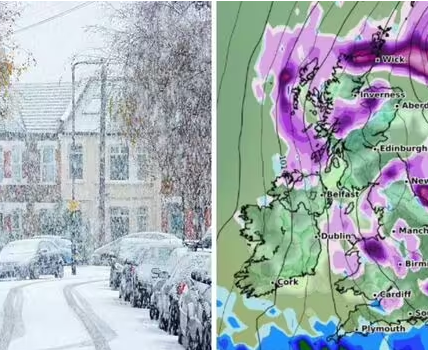

Average annual demands are set to leap by at least 4.99% (Image: Getty Images/iStockphoto)

In just a few days time 24 million households are in for a nasty surprise.

On Tuesday – April 1 no less – Council Tax hikes will bite hard with most seeing bills rise by 5%.

At a time of unprecedented financial misery for struggling families striving to make ends meet it is no April Fool’s joke. The average annual charge for a Band D property is now an eye-watering £2,280 – an increase of £109 on last year’s £2,171. And most will be left wondering what on earth they get for their money.

Cash-strapped councils – many on the brink of going bust – argue the levies represent outstanding value.

But it is an opinion wildly at odds with long-suffering rate payers who for years have bemoaned the parlous state of services Town Halls have a legal duty to provide, with many saying the only bang for their buck is bins being emptied once a fortnight.

Council Tax is a charge on domestic property in England, Scotland and Wales introduced in 1993 to replace the short-lived Community Charge (also known as Poll Tax).

How much you pay depends on the band in which your home falls. The more expensive your castle, the greater the hit.

In England and Scotland, bands are based on the price the property would have sold for in 1991. Wales uses 2003 as its base year while in Northern Ireland it is 2005.

Potholed roads are a familiar sight as cash-strapped councils run out of money (Image: Hereford Times / SWNS)

Broadly speaking the taxes fund local services, including rubbish collection, road repairs, street lighting, libraries, youth clubs, parks and recreation facilities.

But the picture is vastly more complicated than that.

A large slice goes towards the cost of funding care and homes for an increasingly elderly and less independent population, while the police and fire authorities take a chunk.

Analysis by the Local Government Association reveals increasing demand and rising costs meant 61% of council spending in 2023/24 went on children’s services and adult social care – up from 52% in the space of a decade.

And to give some idea of the crisis now affecting almost every town and city, the Government has allowed some councils to increase bills way in excess of the 4.99% cap.

Bradford has been granted permission to slap a 10% increase, while Newham will raise bills by 9%.

Earlier this year Lib Dem-run Royal Borough of Windsor and Maidenhead asked the Government for permission to increase rates by an eye-popping 24.99% claiming that it will effectively go bust if not. It has settled on a 9% rise.

Hampshire – among the counties with the highest concentration of wealth – wanted to implement a 15% rise but was refused. Birmingham, Somerset and Trafford are hiking bills up by 7.5%.

No wonder some are refusing to cough up.

One irate ratepayer said: “It’s going to be hilarious this year as councils start putting pressure on the Government for the thousands who are cancelling their council tax. A summer of non-compliance beckons and [Prime Minister] Sir Keir Starmer will be gone before end of year.”

Another added: “The mass stopping of council tax payment would be a strong message to send until they listen.”

To the horror of those nervously waiting on Tuesday’s post to drop on the doormat, nearly one quarter of all council tax raised is used to fund staff pensions.

Analysis across more than 250 local authorities found almost £7 billion was funnelled into the Local Government Pension Scheme in 2023, roughly £1 in every £4 raised.

Included in the figures was £141.7 million paid into pension pots by Birmingham City Council, which effectively went bust in 2023, the same year as Nottingham and Woking.

That came after Thurrock and Croydon (for the third time) in 2022 – with half of councils warning of effective bankruptcy within five years without urgent reform to the way cash is raised.

Woking 9-5…what a way to make a living: The council went bust in 2023 (Image: Getty Images)

Councils have been struggling to balance the books for years, but pension contributions rocketed in a desperate scramble to keep pace with gold-plated schemes awarded to Town Hall pen pushers unthinkable in the private sector.

One third of local government pension funds are in deficit but figures show 7,609 ex-local authority workers enjoy a pension of more than £50,000 a year and, of those, 203 receive more than £100,000 – three times the national average wage.

Some 2m pensions are already in payment, but another 4.5m on the way, with 26 out of 87 schemes not having enough money to meet obligations at the last time of valuation.

Meanwhile, separate analysis suggests town halls face a £54bn shortfall in funding over the next five years unless the underlying causes of financial pressures are not tackled.

The County Councils Network, PwC and Pixel Financial Management Ltd found that increasing council tax by 3% per year over five years would reduce the gap by less than a third to £37.6bn.

And to make matters worse adult social care, children’s services and home to school transport are set to account for 83% of spending need for local authorities in England, calculations show.

Somehow the unsustainable pressure on local finances has to be squared with the now near universal outcry at the size of bills compared to the services being received. And something has to give.

A walk through any town centre clearly demonstrates taxpayers are hardly getting bang for their buck.

Most will cough up £228 every four weeks for the next 10 months to settle their bills, but for what?

Many town centres have become ghost towns as business close or move online, parking charges are frequently hiked and payment automated, the streets are dirty, roads plagued with potholes, and services that once singled councils out as all-embracing and caring have either been slashed, closed, or shunted into private hands.

Since 2021, six local authorities have declared themselves effectively bankrupt, with others warning they may soon face the same fate.

Woking, in the affluent Surrey stockbroker belt, went pop chasing a distant dream to become the “Singapore of Britain”.

Yet instead of eastern promise, things quickly went south. And even if the council flogged everything it owned it would still be more than £1.5bn in debt, an official report revealed.

It had a core spending power of £16.9m a year but servicing its £2.1bn debt is costing £1.3m a week in interest alone.

The average annual charge for a Band D property from April 1 will be £2,280 (Image: Getty Images/iStockphoto)

The way in which councils are funded has changed. Town Halls used to get most of their money from the Government.

Now the bulk comes from local sources through council tax, business rates, and fees for services like parking, leisure centres, and, increasingly, planning applications. Councils have also dipped their toes into commercial investments, some disastrously so, as in the case of Woking.

A recent Resolution Foundation report found poorer households are short-changed and spending a greater share of their income paying council tax, a scandal that disproportionately affects those in the north.

Pete Marland, of the Local Government Association, said: “Councils recognise that having to increase council tax, to bring in desperately needed funding, places yet more financial burden on households. We remain clear to the Government that it is not the answer to meeting the long-term pressures facing high demand national services.”

Many economists argue Council Tax is outdated, regressive, and grossly unfair to those living in poorer regions and in cheaper properties.

The Institute for Fiscal Studies said: “Council Tax bands in England are still based on property values in April 1991. Since then the relative prices of different properties have changed significantly: for example, official estimates suggest the average price in London is now more than six times what it was in 1995, compared with barely three times in the North East. Moreover, the most valuable properties in 1991 (Band H) attract just three times as much tax as the least valuable properties (Band A), despite being worth at least eight times as much in 1991 and typically even more now, since prices have risen most in areas where they were already highest. Council Tax is therefore both increasingly out of date and arbitrary, and highly regressive with respect to property values. It is ripe for reform.”

The question is, does any government possess the political courage to embark on reform?

Most Popular Comments