Starmer loves freebies from rich chums – but will tax every gift you get from your family!_l

The hypocrisy is staggering. Although I guess we shouldn’t be surprised, given what we’ve learned about Sir Keir Starmer and Chancellor Rachel Reeves since they won the election on July 5.

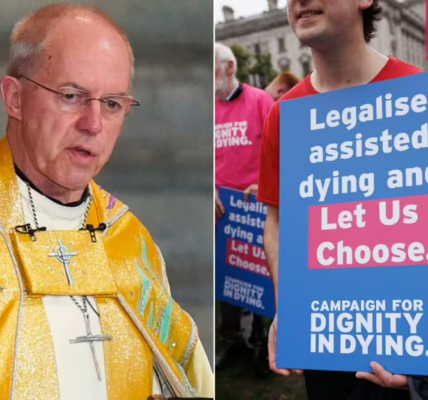

No shame: Keir Starmer and Rachel Reeves have no moral right to tax our gifts (Image: Getty)

We’ve known all the long that the Labour Party would hike one of the most hated taxes of all, inheritance tax (IHT), even if they refused to admit it during the election campaign. The left have been desperate to hike IHT for years, in their battle to reduce wealth inequality.

Finally, they’ve got their chance. What they have no longer got is the moral right to do so. Starmer and Reeves’ love of free gifts from strangers has destroyed that.

As we’ve seen, our new PM loves a freebie more than any other MP. While leader of the opposition, he pocketed nearly £83,780 in gifts and hospitality, including designer clothes and glasses and tickets to several football matches.

Many of these came from by Labour Party donor and peer Waheed Alli, who also funded £5,000 of clothes for Starmer’s wife, Victoria.

Worse, these were not declared within the required 28 days of receiving them.

And of course he didn’t pay tax on any of them. MPs don’t have to, for some reason.

Reeves wasn’t much better, taking £7,500 from a wealthy friend which she spent on clothes.

The hypocrisy is breathtaking, because at the same time as grabbing all the gifts they can these two have been lining up a massive IHT raid on – you guessed it – gifts.

Worse, they’re not targeting gifts given by wealthy benefactors, but your very own family.

Yesterday, Labour sources quietly confirmed what we all knew, that Reeves is going to hike IHT in her Autumn Budget on October 30.

We don’t know exactly how she’s going to do this, but she has plenty of options.

One of them would involve scrapping the £175,000 main residence allowance, a direct attack on families who want to pass their own home to loved ones without the Treasury snatching 40% of its value.

We’re not talking about random donors or mystery friends here, but ordinary parents or grandparents. They don’t have millions at their disposal, like Lord Alli. They merely want to pass on what little wealth they have accumulated to those they love, with no thought of political advantage.

Hilariously, Starmer and Reeves think that’s wrong.

That’s not the only way they’re going to attacked inheritances.

They seem likely to attack family gifting, too. Which is beyond funny, when you think about it for half a second.

Today there is a huge muddle of allowances. People can gift £3,000 a year to anyone they like, within instant IHT exemption. The better off can make unlimited “gifts from surplus income”, provided it doesn’t affect their living standards.

And anyone can make IHT-free gifts provided they live for another seven years afterwards, known as potentially exempt transfers.

It’s a mess and needs tidying up. But not the way Labour is going to do it. And definitely not by a party of avaricious gift grabbers.

One idea kicking around in Labour circles is to set a lifetime cap on the value of gifts people can relieve from loved ones of, say, £30,000. Then tax the surplus at 40% (or possible more).

Presumably that involves tallying up everything people receive over the decades, which grieving families must report to HMRC when a loved one dies.

A bit like Starmer was supposed to declare those clothes for his wife. The difference is that if you somehow forget, or get your sums wrong, HMRC will be after you for tax avoidance.

We will find out what Labour will do on October 30, but there’s one thing we know today. Starmer and Reeves think nothing of taking gifts from random wealthy people or celebs like Taylor Swift, but they hate the idea that you will get them from your own family. Have they no shame?