At last, the Chancellor has triggered an economic recovery.

Chancellor Rachel Reeves knows how to create wealth – just not here (Image: Getty)

That will come as a surprise to many, given her catastrophic handling of the UK economy. Across the country, towns and cities are increasingly desolate as businesses close, jobs vanish and shops get boarded up. There’s a real sense of decline and decay.

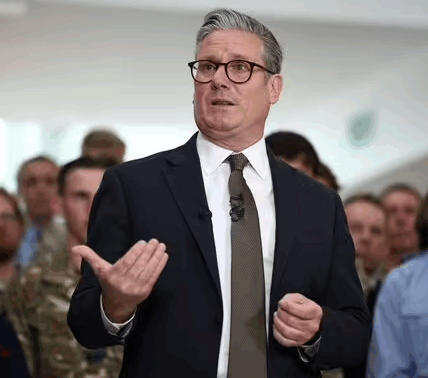

Things were bad under the Tories, but they’ve only got worse under Labour, as Reeves’s relentless tax raids crush sentiment. Growth stalled the moment she and Sir Keir Starmer warned of “difficult decisions” in last year’s Budget. Everyone knew that was code for higher taxes – and they were right.

We got £40billion in new levies last year, and we’re heading for another £30billion this November. Her £25billion hike in employers’ National Insurance has wrecked pubs, bars, restaurants and shops by driving up costs.

Rather than booming, too many towns look like they’ve gone bust.

But one city is booming thanks to Reeves. You’d think she’d be shouting about it, since she’s so desperate for good news.

Yet she’d rather we didn’t know, because that flourishing, prosperous city isn’t in Britain at all. It’s in Italy.

Milan is having a high old time right now as the rich flock there to escape the Chancellor’s constant tax raids, according to The Daily Telegraph.

In Milan, property prices are soaring, private schools are bursting, and new hotels and serviced apartments are popping up everywhere. The streets are lined with luxury cars, discreet wellness clubs and expats snapping up trophy homes.

And many of them are either wealthy Brits or London-based foreign non-doms who until a few months ago were spending their money and paying their taxes here. Not anymore.

Italy has rolled out the red carpet for them, by charging a flat tax for foreigners of €200,000 (£174,000) a year on all overseas income, regardless of how much they earn.

It also frees them from declaring global assets for up to 15 years. These benefits can be extended to family for a modest fee.

Reeves, by contrast, is dragging non-doms into Britain’s inheritance tax net, charging 40% not only on UK assets but worldwide wealth. Many face bills running into hundreds of millions of pounds, or even billions.

Unsurprisingly, they’re not keen to pay. Milan’s gain is London’s loss.

Italy isn’t the only winner. Dubai is teeming with newly arrived Brits fleeing Labour’s war on wealth.

Nik Storonsky, founder of banking app Revolut, shifted his residency to the UAE after calculating that staying here could land him a £3billion capital gains tax bill. It’s hard to fault his logic.

Britain lost a net 10,800 millionaires last year, up from 4,200 the year before, according to a report by report by Henley & Partners and New World Wealth. Only China saw a bigger exodus.

This figure has been disputed. We won’t know for sure for a year or two, until HMRC figures are in. But Reeves is taking a huge gamble as she looks to appease Labour class warriors.

The left will say good riddance. We don’t need the footloose cosmopolitan elite. The problem is, we need their taxes, their businesses, their investment and their spending. Instead, it’s now going to Milan, Dubai and Switzerland.

So yes, Rachel Reeves does know how to engineer a boom – in our rivals’ economies. Sadly, she’s reserving the bust for Britain.